Bookkeeping Jobs: Disappearing or Evolving with Technology?

These can include a profit and loss statement, balance sheet and cash flow statements. They assume that keeping a company’s books and preparing its financial statements and tax reports are all part of bookkeeping. We believe that Bookkeeping and accounting is a very important part of every business.

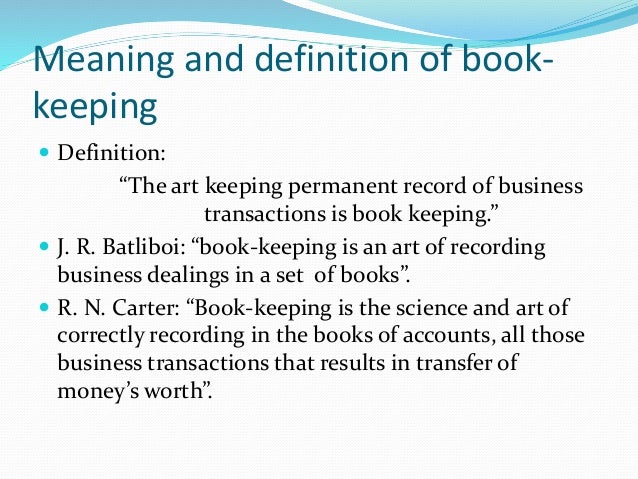

Bookkeeping (and accounting) involves the recording of a company’s financial transactions. The transactions will have to be identified, approved, sorted and stored in a manner so they can be retrieved and presented in the company’s financial statements and other reports. The adjusting entries will require a person to determine the amounts and the accounts.

Both positions often are in offices where you do both independent work and interact with others in the business. As either a bookkeeper or accounting clerk, you usually work full time with extras hours during busy times like tax season, though part-time opportunities exist. Bookkeepers oversee a company’s financial data and compliance by maintaining accurate books on accounts payable and receivable, payroll, and daily financial entries and reconciliations.

They perform daily accounting tasks such as monthly financial reporting, general ledger entries, and record payments and adjustments. Personal Bookkeeping Bookkeepers will also be responsible for preparing some significant financial statements for small businesses.

Without adjusting entries the accounting software will be producing incomplete, inaccurate, and perhaps misleading financial statements. You can look up the steps online, and the ingredients you need are stuff that you can easily find around the house. With enough washes and repeated use, Old Style Aloe Toxin Rid Shampoo can help you pass an hair drug test by clearing your scalp and hair from any traces of substances like weed. We’re confident the Macujo method works if one of the following happens: The user incorporated the Aloe Rid detox shampoo (and it must be the older version) OR Find more info here Prior to computers and software, the bookkeeping retained earnings for small businesses usually began by writing entries into journals. In order to reduce the amount of writing in a general journal, special journals or daybooks were introduced.

Bookkeeping, Accounting, and Auditing Clerks

FinancePal offers a variety of financial services tailored to your industry and business operations. Work with a designated financial expert to help you streamline your accounting, and allow you to prioritize your time where you’re passionate, and most needed. Businesses that have been in operation longer, Bookkeeping manage more employees, or are growth-driven may require more robust bookkeeping services. Speaking of number crunching, that job duty is actually more common to bookkeeping than to accounting. Companies task bookkeepers with tasks such as recording journal entries and conducting bank reconciliations.

Main Takeaways for Hiring a Bookkeeper

- Accountants are more concerned with the larger picture and use the data bookkeepers keep track of to generate reports, identify important trends, and make projections.

- Our team comprises of certified, professional accountants who provide the best services in the industry.

- Outsourced bookkeepers can be another solution with monthly bookkeeping fees starting from $99 per month.

- Accounting clerks typically work for larger companies and have more specialized tasks.

- This ledger consists of the records of the financial transactions made by customers to the business.

- The types of accounts to which this rule applies are expenses, assets, and dividends.

The biggest difference between accounting and bookkeeping is that accounting involves interpreting and analyzing data and bookkeeping does not. As you establish a client base and get more comfortable with your bookkeeping business, continue your learning and consider offering more services.

The special or specialized journals consisted of a sales journal, purchases journal, cash receipts journal, and cash payments journal. Bookkeeping and accounting may appear to be the same profession to an untrained eye. This is because both accounting and bookkeeping deal with financial data, require basic accounting knowledge, and classify and generate reports using the financial transactions. At the same time, both these processes are inherently different and have their own sets of advantages. Read this article to understand the major differences between bookkeeping and accounting.

Some bookkeepers will also prepare VAT returns, run payroll and prepare and file self assessment tax returns. Ultimately, hiring a bookkeeper or financial management company will be different retained earnings formula for every business and bookkeeper costs will vary. Deciding what kind of small business bookkeeping services you need, and what your business can afford is a great place to start.

And any time you add a service is a great opportunity at which to re-evaluate your pricing structure and sell your clients on those new packages! Developing a more robust set of offerings is also a solid way to retained earnings formula attract new clients. All businesses will generate a lot of paper, such as purchase invoices, receipts and expense claims. The bookkeeper will transform a bundle of paper into something orderly and accurate.

Flatworld Solutions has been in this domain for over 16 years now and has served several clients across the world. Our team comprises of certified, professional accountants who provide the best services in the industry. Our bookkeepers and accountants are updated with the changing market scenarios and are skilled to work on emerging tools and technologies. By outsourcing your requirements to us, you can save about 50% of your costs and concentrate more on your core competencies.

As a bookkeeper, your attention to detail must be almost preternatural. Careless mistakes that seem inconsequential at the time can lead to bigger, costlier, more time-consuming problems down the road. Rarely does a bookkeeper work on one big project for an eight-hour shift; rather, a typical workday involves juggling five or six smaller jobs. Common places where both bookkeepers and accounting clerks work include retailers, accounting services firms, wholesalers, financial companies and healthcare facilities. However, in the meantime if you’ve got any experience with the stuff detox product let us know in the comets section below. If it does indeed work, we’d love to pass an the word of another drug detox drink that actually works to help people pass a urine test.

Daily records were then transferred to a daybook or account ledger to balance the accounts and to create a permanent journal; then the waste book could be discarded, hence the name. While bookkeeping and accounting are both essential business functions, there is an important distinction. Bookkeeping is responsible for the recording of financial transactions. Accounting is responsible for interpreting, classifying, analyzing, reporting and summarizing financial data.

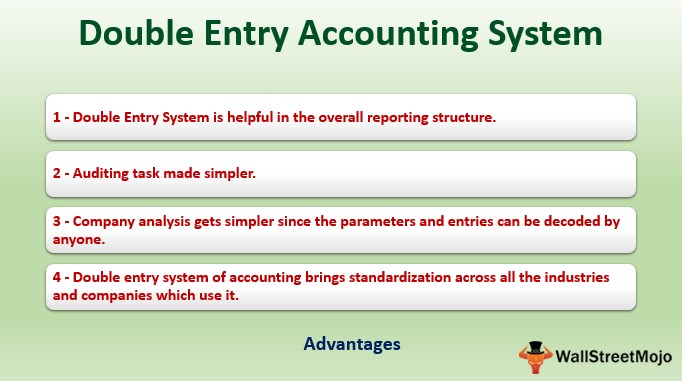

A double-entry bookkeeping system is a set of rules for recording financial information in a financial accounting system in which every transaction or event changes at least two different nominal ledger accounts. The origin of book-keeping is lost in obscurity, but recent researches indicate that methods of keeping accounts have existed from the remotest times of human life in cities. Babylonian records written with styli on small slabs of clay have been found dating to 2600 BCE. The term “waste book” was used in colonial America, referring to the documenting of daily transactions of receipts and expenditures. Records were made in chronological order, and for temporary use only.

Bookkeeping and accounting are two functions which are extremely important for every business organization. Bookkeeping, accounting, and auditing clerks usually get on-the-job training. Under the guidance of a supervisor or another experienced employee, new clerks learn how to do their tasks, such as double-entry bookkeeping. In double-entry bookkeeping, each transaction is entered twice, once as a debit (cost) and once as a credit (income), to ensure that all accounts are balanced. Bookkeepers who work for multiple firms may visit their clients’ places of business.